Over half of Americans now report feeling financially “frozen,” stuck in a state of uncertainty that keeps them from spending, saving, or investing. Rising costs, mounting debt, and economic instability have created a nationwide paralysis that impacts everything from household budgets to the broader U.S. economy. Understanding the root causes, consequences, and actionable strategies can help households regain control and financial confidence.

Understanding Financial Freeze

Being financially frozen goes beyond temporary stress. It represents a state where households hesitate to make financial moves due to anxiety over income, debt, or the economy. People experiencing this freeze often:

● Delay major purchases like homes, cars, or appliances.

● Avoid investing in stocks, retirement accounts, or real estate.

● Postpone paying down debts or refinancing loans.

● Hesitate to increase spending even when financially feasible.

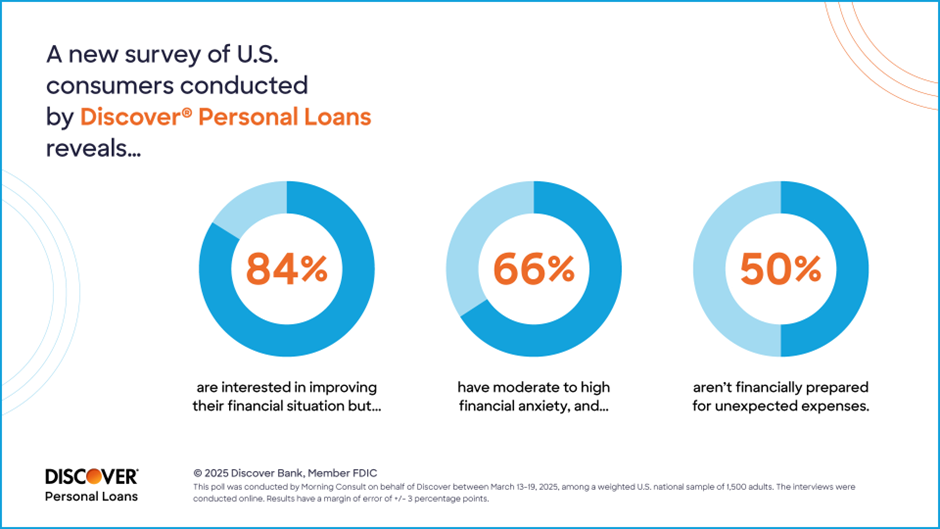

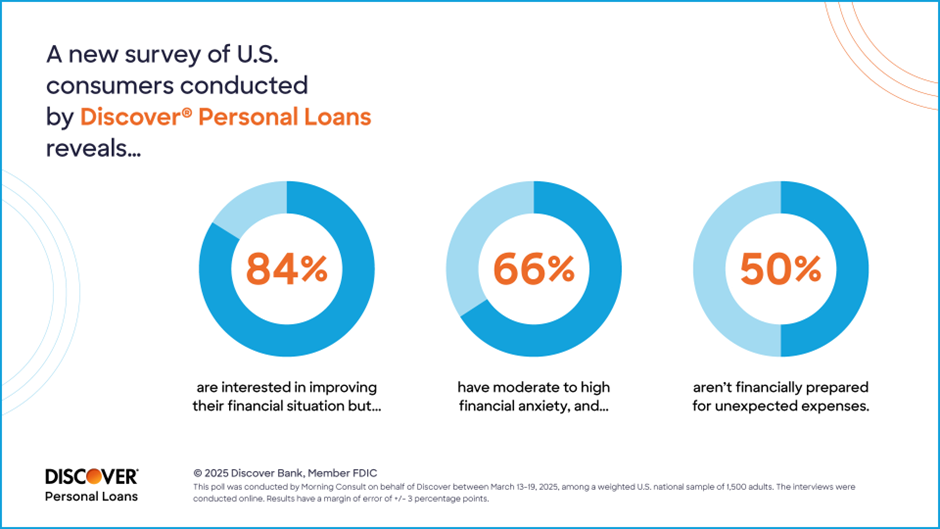

A 2025 Federal Reserve report found that 52% of U.S. adults feel unable to make confident financial decisions, citing inflation and stagnant wages as major factors (Federal Reserve, 2025).

Why So Many Americans Feel Stuck

Inflation and Rising Costs

Rising prices for essentials like groceries, gas, and utilities outpace wage growth.

Example: A typical U.S. household now spends nearly $8,000 more per year on necessities compared to five years ago (Bureau of Labor Statistics, 2025).

Burgeoning Debt

High levels of debt, including credit cards, student loans, and auto loans, can make monthly finances feel overwhelming.

Example: Jane, a 34-year-old teacher in Ohio, allocates 40% of her income to debt payments, leaving little flexibility for savings or investments.

Job Market Uncertainty

Even with low unemployment, gig work, contracting, and potential layoffs keep many cautious. Individuals fear losing income suddenly, prompting emergency savings hoarding rather than financial growth.

Investment Hesitancy

Market volatility discourages long-term investing. Millennials and Gen Z, burned by past downturns, often avoid retirement accounts entirely, preferring short-term cash security.

How Financial Freeze Affects Daily Life

- Reduced Consumer Spending: Households limit discretionary purchases like dining out, travel, and entertainment.

- Deferred Home Ownership: Hesitation to take on mortgages slows housing market growth.

- Delayed Retirement Planning: Savings for retirement are postponed, threatening long-term financial security.

- Mental Health Strain: Chronic financial stress contributes to anxiety, depression, and overall reduced well-being.

Strategies to Thaw Your Financial Freeze

Even in uncertain times, proactive measures can restore financial confidence:

Budgeting and Expense Tracking

● Track income and spending with apps like Mint, YNAB, or Personal Capital.

● Identify non-essential expenses for temporary reduction.

Emergency Fund Prioritization

● Build 3–6 months of essential expenses in a high-yield savings account.

Example: Tom, a 42-year-old freelancer, created his emergency fund in 18 months, allowing for cautious investing.

Debt Management

● Refinance high-interest debt or use snowball/avalanche repayment strategies.

● Seek help from non-profit credit counseling services if needed.

Strategic Investment

● Start small: Even $50–100 monthly in diversified ETFs grows over time.

● Use tax-advantaged accounts like 401(k)s or Roth IRAs to hedge against market volatility.

Side Income and Upskilling

● Explore remote freelancing, online tutoring, or gig work.

● Upskilling can improve employability and increase earning potential.

Real-Life Case Study: Breaking Free

Case: Sarah, 29, marketing coordinator in Texas

● Faced credit card debt and rising rent.

● Tracked expenses and cut discretionary spending by 25%.

● Built a $5,000 emergency fund and started contributing $100/month to a Roth IRA.

● Within 12 months, Sarah regained confidence, planning her first home purchase.

Frequently Asked Questions (FAQs)

1. Why do so many feel financially frozen despite economic recovery?

Rising inflation and uneven wage growth outpace improvements in the broader economy.

2. How does financial freeze affect the stock market?

Reduced household investment slows capital inflows, potentially impacting stock valuations.

3. Are younger generations more affected?

Yes, Millennials and Gen Z report higher financial paralysis due to student debt and high housing costs.

4. Can financial freeze affect the housing market?

Absolutely. Hesitation to take on mortgages slows first-time home purchases.

5. What role does credit card debt play?

High-interest credit cards compound stress, limiting savings and investments.

6. How can emergency savings mitigate financial freeze?

A dedicated emergency fund provides security to make informed financial moves without fear of setbacks.

7. Should I stop investing during uncertain times?

No — even small, diversified investments help build wealth and reduce long-term risk.

8. How are mental health and financial freeze connected?

Financial uncertainty increases stress, anxiety, and depression. Planning reduces psychological strain.

9. Can professional financial advice help?

Yes. Financial advisors create personalized strategies for budgeting, debt management, and investments.

10. Are there government programs to help?

Programs like SNAP, federal student loan relief, and housing subsidies can provide temporary financial relief.

Practical Takeaways

● Knowledge is power: Understanding your finances is the first step to breaking paralysis.

● Small steps matter: Building emergency funds and starting micro-investments gradually restores control.

● Balance is key: Combine budgeting, strategic investing, and debt management for long-term stability.

Conclusion:

Financial freeze affects over half of Americans, but it is reversible. Through budgeting, debt management, emergency funds, and strategic investing, households can regain control and confidence over their financial lives. Awareness, planning, and actionable steps empower individuals to overcome financial paralysis and build lasting security.