Inflation is reshaping American household life—eroding purchasing power, inflating necessities, and widening economic disparities. From soaring grocery and housing bills to rising tariffs and reduced aid, families across income levels struggle with mounting financial stress. This deep-dive explores real-world examples, expert data, and actionable strategies, offering authoritative insight and tangible solutions for readers seeking clarity and control amidst persistent inflation pressures.

Introduction: More Than Numbers—The Human Side of Inflation

Inflation in America is more than an economic trend. It’s the story of families skipping favorite meals at the grocery store, parents cutting back on after-school activities, and young adults putting off buying their first homes. It’s about how a 3% increase in grocery costs or a 17% jump in clothing prices because of tariffs is not just a percentage—it’s a direct hit on family dinners, back-to-school shopping, and household peace of mind.

Today’s inflation is reshaping everyday lives. While policymakers debate statistics and central banks adjust rates, the average American family is navigating stress, uncertainty, and hard trade-offs. This article digs deep into how inflation is affecting American families in 2025, drawing from real stories, authoritative data, and expert advice.

How Much Are Families Feeling the Pinch?

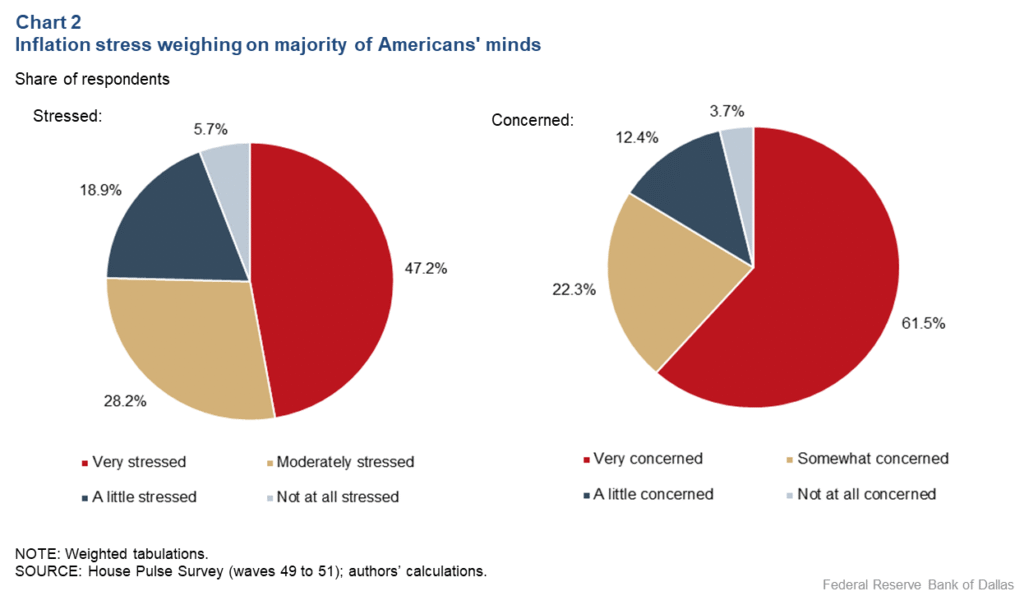

Inflation affects different households in different ways, but the majority of Americans say they’re struggling to keep up. According to a Northwestern Mutual survey, 52% of families report that their income is not growing as fast as inflation, while only 11% say they are ahead.

Take school lunches as an example. MarketWatch reports that the cost of a basic packed lunch—say, a peanut butter and jelly sandwich—rose 6% in just one year. For families with multiple kids, that small increase compounds into a real budget burden. Add tariffs on everyday goods like backpacks and sneakers, and suddenly the back-to-school season feels like an economic battlefield.

And the emotional toll? Families describe the grocery store as a place of stress, where scanning price tags on meat and eggs brings on anxiety. Inflation isn’t just about numbers—it’s about dignity and daily life.

Which Families Are Most Impacted?

Inflation does not hit every demographic equally.

- Low-Income Households: Families living paycheck-to-paycheck are the most vulnerable. When over 80% of their income goes to essentials like food, rent, and utilities, there’s little room to absorb price hikes.

- Black and Hispanic Families: Studies by the Dallas Fed show that inflation-related stress is higher among Black (53.7%) and Hispanic (57.2%) households compared with White (43.6%) and Asian (38.6%) households.

- Middle-Class Families: Known as the “squeezed middle,” this group earns too much to qualify for many aid programs but not enough to keep pace with housing and healthcare costs. The “middle-class squeeze” is real—stagnant wages combined with higher living costs leave these families vulnerable.

- Generational Impact: Middle-aged families often bear the heaviest burden—raising children, saving for college, and supporting aging parents—all while inflation erodes their spending power.

Economists estimate that a 10% permanent inflation rate can cut lifetime spending by 7% for an average household. For middle-aged earners, this figure is even higher, underscoring the long-term wealth erosion families face.

What Are the Drivers of This Inflation?

Several interlinked factors explain why American families are experiencing so much financial strain in 2025.

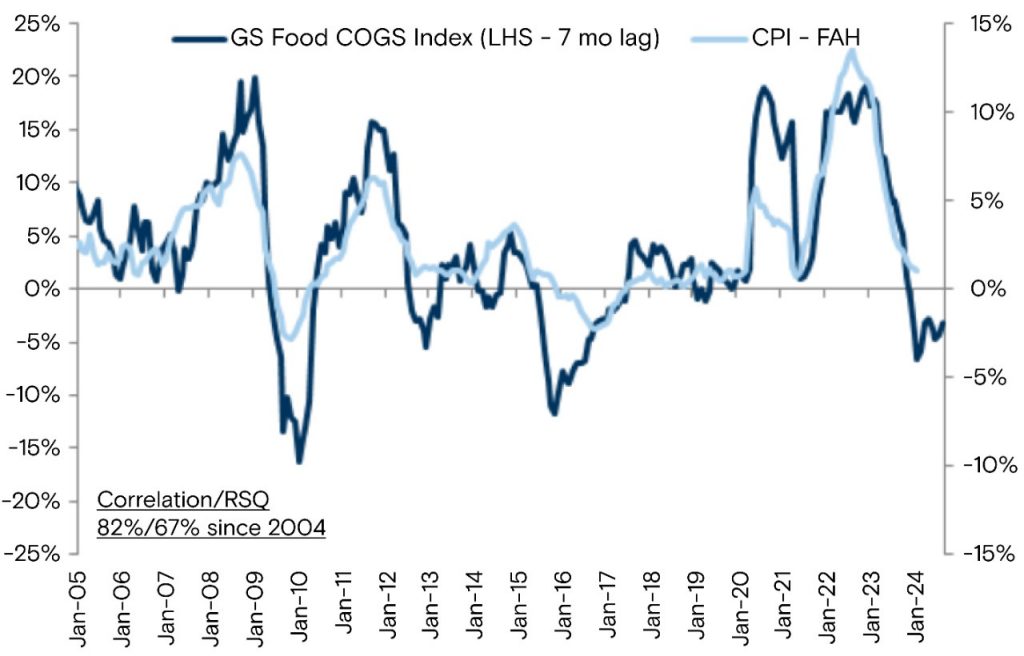

- Food and Groceries: USDA data shows that grocery prices rose 2.2% year-over-year, while eating out jumped nearly 4%. Staples like beef, eggs, and bread have become significantly costlier.

- Housing Costs: Shelter remains one of the single largest drivers of inflation. If housing costs were excluded, overall inflation in 2025 would be just 1.8% instead of 3.2%. With mortgage rates still high and rental demand outpacing supply, housing remains a pain point for families nationwide.

- Tariffs: New tariffs have added approximately $3,800 to household costs annually. For example, clothing prices rose 17% in 2025 due to tariffs, making even basic shopping trips expensive. Families sending kids back to school now spend around $875 per child on supplies and clothing, a figure inflated by tariffs.

- Utilities & Energy: Although energy prices have stabilized slightly, regional spikes in electricity and gas bills continue to pressure families.

- Healthcare & Childcare: Both remain “silent inflators.” Families paying $1,200–$1,500 monthly for childcare or insurance premiums see little relief, even if groceries stabilize.

Real-Life Stories: How Families Are Coping

Numbers tell one story, but personal experiences reveal the human impact.

- A Grocery Story: A mother in Ohio described feeling “a pit in her stomach” when her usual $150 grocery bill turned into $200. Eggs and milk alone ate up more than expected, forcing her to cut snacks and cereals her kids love.

- Delaying the Dream: A young couple in Texas postponed buying a home because rising mortgage rates and inflated housing costs made monthly payments unaffordable. Their dream of moving into a starter home is now “on hold indefinitely.”

- School Struggles: In California, families reported that back-to-school shopping cost nearly $900 this year—up from $650 two years ago. The culprit? Tariffs on imported goods like backpacks, lunchboxes, and sneakers.

- Middle-Class Reality Check: A Wells Fargo study found that nearly 90% of Americans report sticker shock on everyday essentials. Many are delaying weddings, home renovations, and even medical procedures due to rising costs.

Inflation is changing not just how families spend, but how they plan their futures.

What Practical Steps Can Families Take?

While no family can fully escape inflation, there are ways to soften the blow.

Smart Budgeting Tips:

- Focus on essentials first: groceries, rent, healthcare.

- Explore generic brands and bulk shopping at Costco, Sam’s Club, or local wholesalers.

- Use meal planning apps to avoid waste and stretch food dollars.

- Take advantage of discount days and cashback cards when shopping.

Strategic Spending:

- Delay non-essential big-ticket items (travel, electronics, furniture).

- Refinance or lock-in fixed mortgage and auto loan rates when possible.

- Use energy-efficient appliances to cut utility bills.

Community Resources:

- Apply for SNAP benefits, school meal programs, or local food banks.

- Check if your state offers utility bill relief programs or childcare subsidies.

Income & Resilience:

- Consider side hustles or part-time freelancing.

- Negotiate raises—employers are increasingly aware of inflation’s impact.

- Build emergency savings, even if in small amounts.

Frequently Asked Questions (FAQs)

1. How can families beat the rising cost of groceries?

Families can fight rising grocery costs by meal planning, buying in bulk, and freezing leftovers to minimize waste. Switching to generic brands and affordable staples helps stretch budgets further. Cashback apps like Ibotta and Fetch provide savings opportunities, while discount shopping at wholesalers like Costco adds extra relief.

2. Are tariffs really making everything more expensive?

Yes, tariffs in 2025 added roughly $3,800 in extra annual household costs. Families especially feel this with higher prices on clothing, school supplies, and household essentials. For parents shopping during back-to-school season, tariffs drive up expenses on items like backpacks, sneakers, and electronics—making everyday family living considerably more expensive.

3. Is inflation still going up in 2025?

Inflation in 2025 continues to rise, though slower than in previous years. Rates grew from 2.4% early in the year to around 2.8% mid-year. Persistent housing costs and tariffs remain primary drivers, while groceries and energy prices contribute moderately. Families are still experiencing real financial strain nationwide.

4. Who is hit hardest by inflation?

Low-income households, renters, and minority families—especially Black and Hispanic communities—bear the greatest burden. These groups typically allocate a higher share of income to essentials, leaving little room to absorb price increases. Middle-class families also feel squeezed as wages stagnate while the costs of housing, groceries, and healthcare rise steadily.

5. Why is housing inflation so persistent?

Housing inflation persists due to limited supply and high demand. Zoning restrictions, construction delays, and investor activity keep prices elevated. Rising mortgage rates also prevent affordability improvements, making homeownership harder for families. Renters face steep increases too, with nationwide demand far exceeding available units, driving continued housing cost pressures.

6. Is food inflation easing?

Food inflation has slowed but remains uneven. Overall grocery inflation eased to 2.2%, but protein-rich staples like beef, poultry, and eggs remain disproportionately expensive. While families may notice modest relief on produce and pantry items, core essentials continue to strain budgets, especially for larger households with growing children.

7. Can federal aid help?

Yes, federal aid programs such as SNAP benefits and free or reduced-price school meals provide essential relief for millions of families. However, changes in eligibility rules and potential funding cuts mean many middle-income households don’t qualify for help, leaving them vulnerable to inflation’s full impact without government assistance.

8. How can families prepare for future inflation shocks?

Families can prepare by diversifying income sources, building emergency savings, and closely tracking household budgets. Cutting unnecessary expenses and locking in fixed loan rates offer extra protection. Exploring side hustles, part-time work, or freelancing helps increase income, while staying informed on price trends ensures smarter long-term financial decisions.

9. Are wages keeping up with inflation?

No, most wages are failing to keep up. While some sectors saw pay raises, overall income growth lags behind inflation rates. This gap forces families to stretch earnings thinner across essentials like rent, groceries, and healthcare. Without stronger wage growth, purchasing power continues eroding, especially for working-class households.

10. How does inflation affect mental health?

Inflation significantly impacts mental well-being. Families under constant financial pressure report higher rates of anxiety, stress, and depression. Budget worries affect relationships, parenting, and daily peace of mind. Addressing mental health—through counseling, stress-management techniques, or community support—is as important as financial planning during prolonged inflationary periods.

Key Takeaways

- Inflation remains the top financial concern for American families in 2025.

- Rising grocery and housing costs, combined with tariffs, are the biggest drivers of pressure.

- Families are coping by cutting spending, using aid programs, and delaying life milestones.

- Practical steps—budgeting, refinancing, community resources, and side hustles—help, but systemic pressures remain.

- Emotional and mental health effects are as significant as financial ones, underscoring the need for holistic solutions.

Conclusion

Inflation is more than an abstract concept—it’s a daily reality shaping the way American families eat, live, and dream. Whether you’re a parent struggling with school supply costs, a renter juggling higher bills, or a middle-class family putting life milestones on hold, you’re not alone. While policy solutions are still in debate, the resilience of American households shines through. With the right strategies, community support, and long-term awareness, families can weather the storm and plan for brighter days ahead.