The U.S. stock market in 2025 is navigating a complex landscape shaped by Federal Reserve policy shifts, easing inflation, technological innovation, and geopolitical risks. Investors are monitoring mega-cap tech earnings, AI-driven growth, consumer spending recovery, and global capital flows. This in-depth article explores key stock market trends, sector outlooks, risks, and investor strategies with real-life examples, FAQs, and practical takeaways for anyone following U.S. equities.

Introduction: Why 2025 Is a Pivotal Year for U.S. Stocks

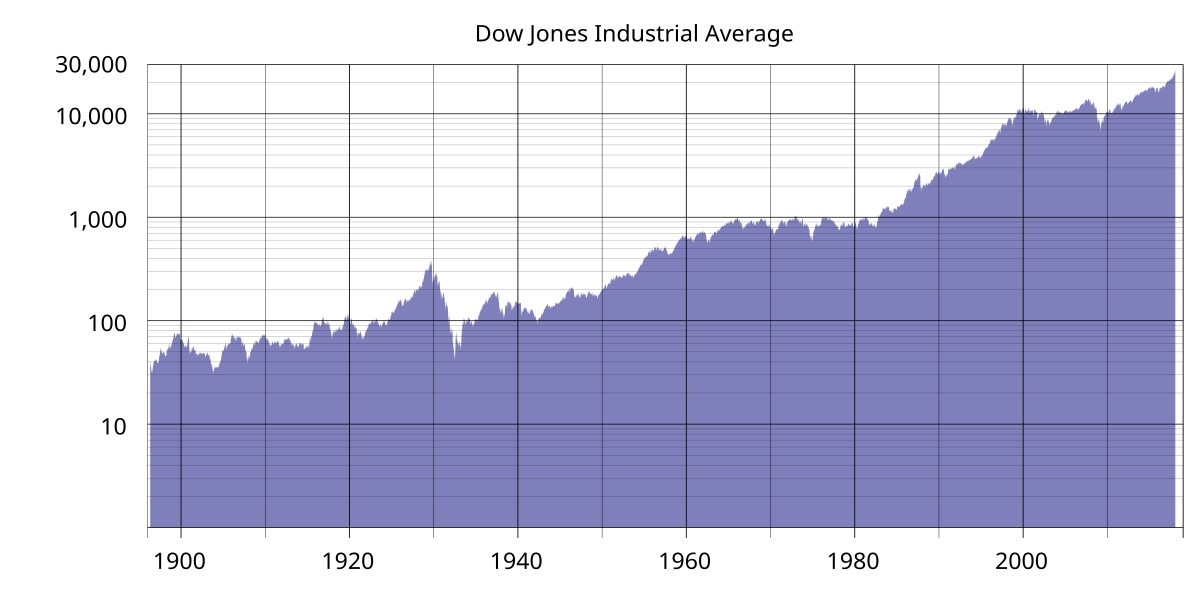

The American stock market has been through remarkable cycles in recent decades—from the dot-com boom and bust of the early 2000s to the global financial crisis of 2008, and more recently, the COVID-19 pandemic’s wild swings. Each chapter tested investors’ patience and strategies, leaving behind valuable lessons.

Now in 2025, investors find themselves in yet another transformational period. The Federal Reserve is delicately balancing interest rates, inflation is finally easing after years of strain, artificial intelligence is no longer just hype but a real profit engine, and geopolitical risks—from China to the Middle East—continue to shape investor sentiment.

At the same time, retail participation remains strong, creating market moves once driven only by institutional giants. Understanding these dynamics is not just helpful—it’s essential. This article breaks down today’s most important U.S. stock market trends, combining analysis with relatable examples and practical investor guidance.

How Inflation Continues to Influence U.S. Equities

Inflation has been a dominant theme in financial markets since 2021. For much of that period, rising prices put pressure on both consumers and companies, leading the Federal Reserve to aggressively raise interest rates.

In 2025, the situation looks different. Inflation has cooled from its 9% peak in 2022 to around 3%. That shift matters because inflation impacts virtually every corner of the market:

- Federal Reserve actions: The Fed slowed its rate hikes in late 2024 and has hinted at potential cuts later in 2025. Lower interest rates typically benefit growth stocks, particularly in technology, as their future earnings become more attractive.

- Consumer purchasing power: With prices stabilizing, American households are slowly regaining confidence. Discretionary spending on travel, entertainment, and lifestyle products is ticking up, benefiting companies in these sectors.

- Corporate costs: Companies with heavy input costs—like airlines dealing with fuel prices or industrial manufacturers reliant on raw materials—still face margin pressures, though less severe than in previous years.

Real-life example: Walmart’s 2025 earnings report exceeded Wall Street expectations, with executives attributing stronger sales to easing grocery inflation. The company’s stock surged 8% after the announcement, underscoring how inflation trends directly affect market performance.

How Artificial Intelligence Is Reshaping the Market

AI has become the dominant investment narrative of the decade. What started as hype in 2023 is now materializing into real business value. In 2025, AI is transforming both corporate growth and investor portfolios.

- Tech giants leading the way: Microsoft, Alphabet, and NVIDIA remain the biggest beneficiaries. Each has reported billions in new revenue tied to AI-driven software, chips, and services.

- AI adoption beyond tech: Healthcare companies are using AI for faster drug discovery, logistics firms are deploying AI for supply chain optimization, and financial institutions are embedding AI into fraud detection and risk modeling.

- Valuation surge: AI-related stocks are often trading at premium valuations, reminiscent of the dot-com bubble, but unlike the 2000s, today’s AI leaders are profitable and cash-rich.

Real-life example: NVIDIA’s Q1 2025 earnings showed data center revenue surging 150% year-over-year due to AI demand. The news sent its stock soaring, adding nearly $300 billion in market capitalization within a week—a reminder of how concentrated AI-driven gains have become.

The Retail Investor’s Growing Influence

The democratization of investing is one of the most important cultural shifts in financial markets. Since the pandemic, retail traders have maintained a strong presence. According to Goldman Sachs, retail activity now accounts for nearly 20% of daily U.S. stock trading volume.

- Meme stocks may have faded, but not retail power: While GameStop and AMC no longer dominate headlines, online communities such as Reddit’s r/WallStreetBets continue to spark sudden surges in certain stocks.

- Shift toward ETFs: Many retail investors are maturing in their strategies, moving from speculative bets to long-term positions in broad-market ETFs like SPY (tracking the S&P 500) and QQQ (tracking the Nasdaq 100).

- Options trading boom: Short-dated options remain a retail favorite, often creating exaggerated swings in stocks around earnings seasons.

Real-life example: In February 2025, Tesla’s stock soared 12% in a single day after retail traders aggressively bought call options ahead of its announcement of AI-powered autonomous driving features. Institutional analysts were cautious, but retail enthusiasm drove the short-term rally.

Sector Trends Driving Market Sentiment

Different industries are experiencing vastly different realities in 2025.

Technology: The Unstoppable Engine

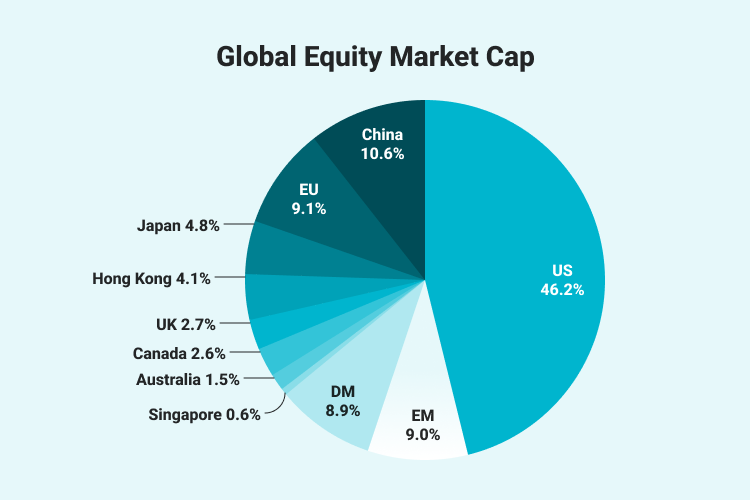

Technology continues to dominate the U.S. stock market. Apple, Microsoft, and NVIDIA remain the backbone of the S&P 500’s growth. Cloud computing, digital ads, and AI integration are the biggest profit drivers.

Energy: The Battle Between Oil and Renewables

Energy is split between traditional oil giants and renewable innovators. ExxonMobil and Chevron benefit from oil price volatility, while companies like NextEra Energy attract ESG-driven capital. Transition risk is real—investors are carefully balancing short-term profits with long-term sustainability.

Healthcare: An Aging America

The U.S. population is aging, driving healthcare demand. Biotech startups are racing to bring therapies to market, while insurance providers like UnitedHealth are navigating regulatory pressures.

Consumer Discretionary: Confidence Returns

As inflation eases, Americans are spending more on experiences. Disney reported subscriber growth in its streaming platform while also benefiting from record park attendance. Airlines such as Delta have posted record passenger volumes.

Financials: Rate Sensitivity

Banks thrive or struggle depending on Fed policy. Large players like JPMorgan Chase remain resilient, while regional banks—still recovering from liquidity scares—are more vulnerable.

Geopolitical Factors Investors Can’t Ignore

Markets don’t operate in isolation. Global politics shape capital flows and investor sentiment.

- U.S.–China relations: Semiconductor companies face risks from export restrictions. Any escalation can trigger sharp selloffs.

- Middle East conflicts: Oil remains a geopolitical weapon, and instability in the region drives price spikes, impacting energy and transportation.

- Election year uncertainty: With a U.S. presidential election looming, investors are bracing for potential policy changes around corporate taxation, regulation, and trade.

Real-life example: In early 2025, tensions in the South China Sea caused chip stocks like AMD and Qualcomm to tumble nearly 10% in a week, showing how geopolitics can swiftly shift market sentiment.

Practical Takeaways for Investors

- Inflation cooling is a positive sign for equities.

- AI is more than hype—it’s delivering tangible revenue.

- Retail investors continue to shape short-term market moves.

- Diversification remains essential, with tech, healthcare, and selective energy stocks looking most promising.

- Geopolitical risks are the unpredictable wildcards.

FAQs: Trending Investor Questions About the Stock Market

Is the U.S. stock market bullish or bearish in 2025?

The U.S. stock market is experiencing a selective bull phase in 2025. While tech-heavy indexes like the Nasdaq have reached new highs, other sectors lag behind. Investors are seeing uneven gains, meaning some areas are thriving while others face pressure. Diversification remains crucial for balanced returns.

What stocks are driving market gains this year?

Mega-cap technology companies are leading U.S. stock market gains in 2025. Apple, Microsoft, NVIDIA, Alphabet, and Amazon are contributing a significant portion of S&P 500 performance. These firms continue to benefit from AI adoption, cloud services, and digital innovations, keeping their valuations elevated and driving overall market momentum.

Will interest rate cuts boost the market?

If the Federal Reserve cuts interest rates later in 2025, equities—especially growth-focused sectors like technology—could see a boost. Lower rates reduce borrowing costs, improve corporate earnings, and enhance investor confidence. However, timing and market expectations will determine the magnitude of any rally triggered by rate cuts.

How is AI impacting valuations?

Artificial intelligence is significantly influencing market valuations in 2025. Tech companies leveraging AI have added trillions to their market caps. While AI drives growth, investors should remain cautious and monitor whether stock prices are supported by earnings, as some valuations may become inflated if expectations outpace actual performance.

Are retail investors still relevant?

Retail investors continue to play a major role in 2025, accounting for nearly 20% of daily trading volume. Platforms like Robinhood, Webull, and Fidelity facilitate widespread participation, particularly in ETFs and options. Retail activity can amplify short-term market movements, impacting both momentum and volatility in certain sectors.

Is a recession likely in 2025?

Recession risks in 2025 appear relatively low, with U.S. GDP growth holding around 2%. Consumer spending remains resilient, and corporate earnings are stable in key sectors. Nonetheless, external shocks, geopolitical tensions, or sudden economic policy changes could introduce uncertainty, so investors should stay prepared for potential volatility.

Which sectors provide the most stability?

In times of uncertainty, healthcare, utilities, and consumer staples remain the most stable sectors. These industries offer consistent demand and resilient cash flows, providing defensive characteristics against market volatility. Investors often turn to these sectors during economic slowdowns or geopolitical unrest to protect portfolio value and reduce downside risk.

How do elections affect markets?

U.S. elections often trigger short-term market volatility due to policy uncertainty. Investors may experience temporary fluctuations in stock prices, interest rates, and sector performance. Historically, markets adjust after election outcomes become clear, with long-term trends driven more by economic fundamentals than political cycles.

Are stocks overvalued?

Some U.S. stocks, particularly in the technology sector, are trading at elevated valuations in 2025, reflecting strong growth expectations. However, earnings support many of these prices. Energy and financial sectors appear more reasonably priced, offering value opportunities. Investors should assess risk and balance growth with fundamentals.

Should long-term investors stay invested?

Yes, staying invested long-term remains a proven strategy. Historical data shows that maintaining positions through market volatility often outperforms attempts at timing the market. Diversifying across sectors, focusing on quality companies, and exercising patience can help investors navigate short-term swings while achieving sustainable long-term returns.

Conclusion: Navigating the Stock Market With Confidence

The U.S. stock market in 2025 is a story of transformation. Inflation has eased, the Federal Reserve is cautious but supportive, artificial intelligence is reshaping industries, and retail investors are firmly part of the landscape. At the same time, geopolitical tensions and election-year uncertainty add volatility.