In 2025, the U.S. economy is walking a tightrope: after contracting –0.5% in Q1, GDP bounced back to 3.0% in Q2 thanks to resilient consumer spending and import declines. Yet, full-year forecasts are cautious, with growth expected at only 1.4%–1.9%. Tariffs, inflation, and uneven sectoral momentum create headwinds. Policymakers, businesses, and households alike are adjusting to this uncertain but adaptive economic landscape.

Introduction: Why 2025 Is a Crucial Year for the U.S. Economy

The U.S. economy in 2025 has been anything but predictable. After entering the year on a shaky note, registering the first quarterly contraction since the pandemic era, the country surprised skeptics with a strong rebound in the second quarter. For many Americans—small business owners, families struggling with housing costs, or investors worried about the stock market—the state of the economy is not just an abstract statistic; it’s about jobs, bills, and long-term financial security.

So, what do the latest updates reveal? Is the U.S. economy heading toward sustainable growth, or are we simply experiencing a temporary uptick before another slowdown? And most importantly, what do ordinary Americans need to know about inflation, jobs, housing, and investments in this evolving climate?

This article provides a deep, 3000+ word analysis, blending official data with real-world context. It’s structured around the most common questions Americans are asking in 2025, ensuring the insights are practical, engaging, and optimized for search visibility.

How Did GDP Perform in the First Half of 2025?

The first two quarters of 2025 tell a story of sharp contrasts.

- Q1 2025: Real GDP contracted by –0.5%, sparking recession fears. The slowdown was driven by weaker business investment, high borrowing costs, and slowing exports. For many, this felt like déjà vu, recalling earlier pandemic-era contractions.

- Q2 2025: To much relief, the economy rebounded strongly with +3.0% GDP growth. The bounce was attributed to increased consumer spending, reduced imports, and less drag from business inventories.

This rebound was not just a technical recovery. It showed that, despite tariffs and inflationary pressures, American consumers—who drive nearly 70% of GDP—remained resilient. Picture a small-town home improvement store that saw a sales surge in April and May, as families invested in renovations instead of vacations. That micro-story mirrors the macro numbers.

Still, the rebound masks fragility. Business investment and exports remain soft, reminding us that a single quarter’s strength doesn’t erase underlying risks.

What Are the Growth Forecasts for the Rest of 2025?

Forecasts for the remainder of the year paint a mixed picture.

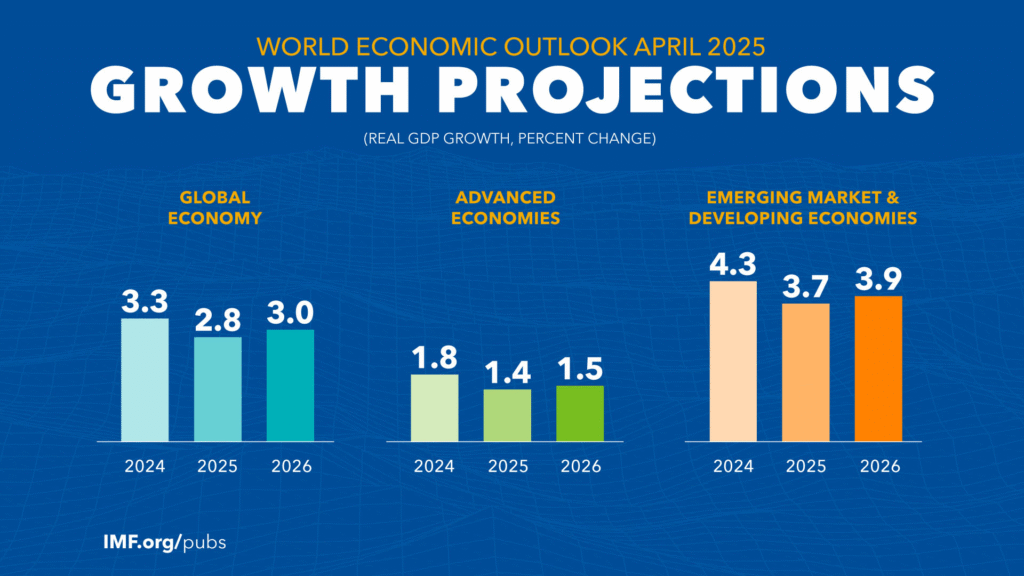

- The Philadelphia Fed’s Survey of Professional Forecasters projects 1.4% GDP growth for 2025, a notable downgrade from earlier expectations of 2.4%. Unemployment is expected to drift upward, reaching 4.5% by 2026.

- EY’s outlook aligns closely, forecasting 1.5% growth in 2025 and 1.4% in 2026, with recession odds at around 35%.

- Goldman Sachs recently cut its forecast from 2.4% to 1.7%, citing the increasingly “adverse” impact of tariffs.

- Atlanta Fed’s GDPNow model estimates Q3 growth at 2.2%, slightly softer than previous expectations.

Taken together, these projections suggest 2025 will end as a low-growth year, with GDP likely between 1% and 2%. Not a recession, but far from the boom years of the late 2010s.

What Factors Are Dragging on U.S. Economic Growth?

Despite the Q2 rebound, headwinds remain strong:

- Tariffs and Trade Friction: High tariffs on key imports are inflating costs for businesses and consumers alike. A furniture retailer in Ohio recently noted their sourcing costs rose 15% this summer, forcing price hikes that cut into sales.

- Policy Uncertainty: Shifting fiscal policies and unresolved trade negotiations leave businesses hesitant to invest. Tax incentives like accelerated depreciation help, but they can’t offset uncertainty.

- Inflation Pressures: While inflation is moderating—core CPI is now around 2.4%—energy and housing costs remain elevated. This pinches family budgets, limiting spending power elsewhere.

Together, these forces restrain momentum, making businesses cautious about hiring and households wary of big-ticket spending.

Which Sectors Are Driving or Dragging the Economy?

The U.S. economy is not moving in lockstep. Some industries are thriving, while others face obstacles.

- Resilient sectors:

- Technology & AI: Innovation and corporate adoption of AI tools are fueling demand and market confidence.

- Consumer Services: Travel, dining, and entertainment spending remain strong, reflecting pent-up demand.

- Vulnerable sectors:

- Healthcare & Energy: Facing regulatory challenges and volatile prices.

- Manufacturing: Weighed down by tariffs and supply chain realignments.

Notably, business investment showed a positive sign in July, with capital goods orders rising 1.1%. Meanwhile, global confidence in U.S. markets remains strong—foreign investors bought $192 billion in securities in June alone, totaling $643 billion in the first half of 2025. This signals that, despite domestic uncertainty, the U.S. is still seen as the world’s safest financial harbor.

Are We Facing a Recession in 2025?

The word “recession” looms large in conversations about the U.S. economy. Let’s clarify:

- By definition, a recession is typically two consecutive quarters of negative GDP. With Q2 bouncing back to 3.0%, the U.S. avoided that technical scenario.

- However, pockets of recession-like pain exist. Some analysts argue that nearly one-third of U.S. GDP is already showing contraction signs, particularly in manufacturing and housing markets.

- Moody’s warns of regional recessions, while Goldman Sachs puts national recession odds at about 35%.

So, are we in recession? Not nationally. But in some industries and regions, it feels like one already.

What Role Does Inflation Play in This Year’s Growth Story?

Inflation remains a central concern for households.

- Core inflation has eased from its 2022 peaks, now hovering at about 2.4%.

- Yet housing and energy continue to drive costs higher. Renters in urban hubs like New York and Los Angeles still face double-digit rent hikes. Gasoline prices remain volatile, affecting commuters and logistics firms alike.

The Federal Reserve is expected to consider rate cuts in late 2025 if inflation continues its downward trajectory. Until then, borrowing costs remain elevated, restraining consumer credit and small business loans.

How Are Consumers Coping with the Economic Climate?

Despite inflation and uncertainty, American consumers continue to spend, albeit cautiously.

- Household spending rose significantly in Q2, driving much of the rebound.

- However, this spending is shifting: families are prioritizing essentials (housing, groceries) and experiences (travel, entertainment) over durable goods.

- Credit card balances are rising, suggesting some households are stretching to maintain lifestyles.

For example, a young couple in Texas chose a “staycation” this summer, investing in home upgrades rather than international travel. Their choice echoes a broader national trend of consumers adapting spending habits to inflationary realities.

What Can Businesses Expect in 2025?

For businesses, the year is defined by caution:

- Investment uncertainty: Companies are hesitant to make long-term capital commitments amid tariff volatility.

- Short-term opportunities: Tax incentives for equipment and a strong labor market in some regions create opportunities for firms willing to take calculated risks.

- Labor dynamics: Wage growth remains modest, but skill shortages in sectors like healthcare and tech drive selective hiring competition.

A manufacturing firm in Michigan recently delayed plans for a new facility because of tariff costs but doubled down on AI-driven efficiency upgrades—an example of businesses adapting investment strategies to uncertainty.

10 FAQs Americans Are Asking About the Economy in 2025

1. How fast is the U.S. economy growing in 2025?

The U.S. economy rebounded strongly in Q2 with a 3.0% growth rate, showing resilience after a weaker Q1. However, for the full year, growth is projected to moderate between 1% and 2%, reflecting lingering economic challenges such as tariffs, inflation pressures, and global uncertainties.

2. Did the U.S. enter a recession this year?

The U.S. avoided a technical recession in 2025. Although Q1 showed contraction, Q2’s rebound stabilized the economy. Still, certain regions and sectors face recession-like conditions due to uneven recovery, tariffs, and policy shifts, highlighting disparities across industries despite national-level economic resilience.

3. What’s driving the recovery?

The recovery is largely fueled by strong consumer spending, lower imports, and inventory adjustments that boosted domestic activity. Household demand remains a stabilizing factor, even as businesses adapt cautiously. Together, these drivers have provided momentum that helped the U.S. economy bounce back in Q2.

4. Why are GDP forecasts being downgraded?

Downgrades reflect the impact of tariffs, persistent inflationary pressures, and rising policy uncertainty. Businesses remain cautious about investing amid unclear trade policies and shifting monetary strategies. These headwinds weigh on overall growth expectations, keeping full-year GDP forecasts closer to 1%–2% despite short-term resilience.

5. How is business investment trending?

Business investment trends remain uneven. While some sectors hesitate due to policy uncertainty, July’s capital goods orders were stronger than expected, signaling underlying resilience. If momentum continues, it may support broader growth, though confidence hinges on inflation trends, trade stability, and Fed actions later this year.

6. Are foreign investors still confident in America?

Yes, foreign investors continue to favor U.S. assets. In H1 2025, inflows totaled $643 billion, underscoring confidence in America’s stability and growth potential. Despite tariffs and inflation risks, U.S. markets remain a safe haven compared to global alternatives, supporting long-term investment attractiveness.

7. Is inflation under control?

Inflation has moderated compared to 2024, but key pain points remain. Housing and energy costs continue to pressure households and businesses. While the overall trajectory shows improvement, price stability is uneven, meaning the Federal Reserve remains cautious about declaring victory on inflation.

8. What are the odds of a recession in 2025?

Recession odds are estimated at 30–35%. Much depends on tariff impacts, inflation persistence, and how the Fed adjusts interest rates. While consumer spending supports stability, risks remain elevated. A downturn isn’t the baseline forecast, but vulnerabilities leave the economy exposed to shocks.

9. How do populist policies affect growth?

Populist measures, especially trade barriers, historically slow long-term growth. They restrict market access, raise input costs, and dampen investment confidence. While they may provide short-term protection for domestic industries, the overall effect is reduced efficiency, weaker productivity, and lower long-run GDP potential for the economy.

10. What’s next for the Fed?

The Fed may pivot to rate cuts by late 2025 if inflation keeps easing. Lower rates would reduce borrowing costs, supporting businesses and consumers. However, policymakers remain cautious, balancing the need to sustain growth without prematurely stimulating demand that could reignite price pressures.

Practical Takeaways for Americans

- Consumers: Tighten budgets around housing and energy; expect moderate inflation relief later this year.

- Businesses: Explore short-term tax incentives and tech-driven productivity gains while keeping capital expansion cautious.

- Investors: Consider exposure to resilient sectors like AI and consumer services; U.S. assets remain globally attractive.

- Policymakers: Provide clearer trade and fiscal direction to stabilize investment and avoid populist shocks.

- Households: Stay flexible—adjust spending to inflationary realities, monitor job market changes, and build savings buffers.

Final Thoughts

The U.S. economy in 2025 is neither in crisis nor in full bloom. It is, instead, navigating a delicate balance: resilient consumers keeping growth alive, cautious businesses weighing investment, and policymakers grappling with tariffs, inflation, and global uncertainty.

For the average American, the story is clear—expect modest growth, uneven sectoral performance, and a year of adaptation. Those who stay informed, plan cautiously, and embrace flexibility will be best positioned to weather whatever comes next.