The 2026 U.S. midterm elections are projected to shatter all political ad-spending records, crossing $10 billion. Discover why this surge is happening, where the money’s going, how it could shape influence, and what it means for campaigns, brands, and voters.

The 2026 U.S. midterm elections are poised to become the most expensive and influential in American history. Analysts project political ad-spending could surpass $10 billion, fueled by early spending, high-stakes battles for control, and the explosive rise of Connected TV (CTV) and streaming ads. This comprehensive analysis explores what’s driving this surge, how it could reshape media and democracy, and what campaigns, brands, and voters should prepare for.

Why Everyone’s Talking About 2026 Already

What Makes the 2026 Midterms Different?

In previous cycles, ad-spending typically surged during the final 9–12 months before Election Day. But the 2026 midterms are breaking that pattern. The campaign machinery has kicked in much earlier — and much harder.

Here’s what’s making this election cycle historic:

- AdImpact projects $10.8 billion in political and issue-advocacy advertising during the 2026 cycle — a 20%+ jump from 2022’s $8.9 billion.

- Assembly, a leading media agency, predicts $10.1 billion, confirming the “most expensive midterm ever.”

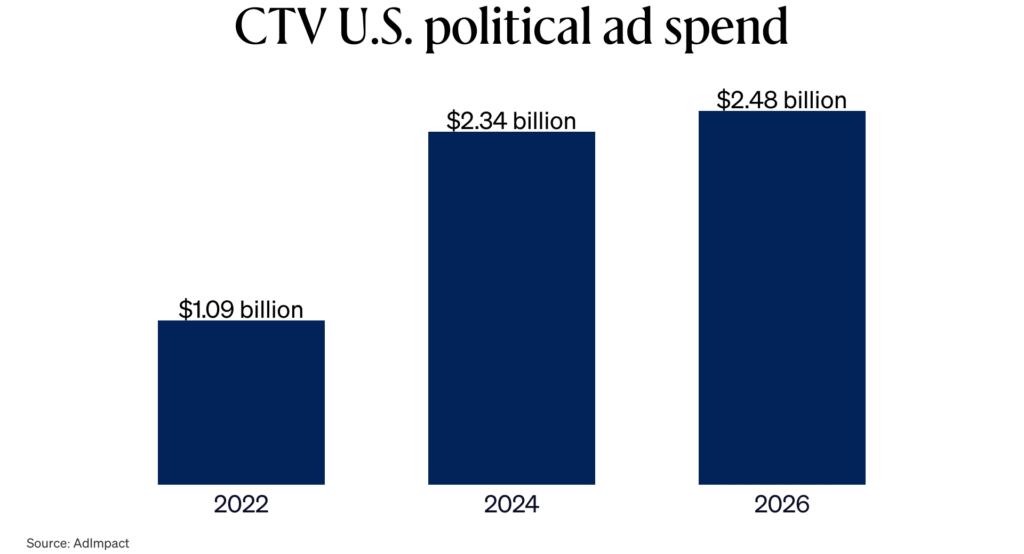

- Streaming and Connected TV (CTV) advertising are fueling the surge, with ad spend here projected to hit $2.5 billion, up ~20% from 2024.

- Early spending has already surpassed $900 million by mid-2025 — a record early pace.

- Battleground volatility: control of the U.S. Congress, statehouses, and key gubernatorial seats is up for grabs, pulling in national, local, and issue-based spending.

The numbers tell a clear story: 2026 will likely redefine political advertising economics — and influence along with it.

How Big Could This Surge Be — The Numbers Tell the Tale

The Hard Data

| Source | Projected 2026 Spend | Change vs 2022 | Notable Insight |

|---|---|---|---|

| AdImpact | $10.8 B | +20% | Highest midterm in history |

| Assembly | $10.1 B | +15% | Streaming leads growth |

| AdImpact (CTV) | $2.5 B | +20% | Connected TV expansion |

| 2022 Actual (AdImpact) | $8.9 B | — | Previous record |

The Midwest battleground markets such as Michigan, Wisconsin, and Pennsylvania are seeing the highest ad intensity. Michigan’s AMII (Ad Market Intensity Index) is projected around 9.17, indicating near-total media saturation.

Why It Matters

When the same inventory (TV, CTV, and digital slots) attracts double the money:

- Costs explode, pricing out smaller campaigns and local advertisers.

- Message frequency spikes, leading to ad fatigue among voters.

- Influence concentration increases — large PACs and corporate interests dominate discourse.

- Down-ballot candidates (state and local level) face higher entry barriers.

In effect, the midterms are becoming a national media arms race.

Key Drivers Behind the Spending Surge

Battleground Intensity

The Senate and House maps are loaded with competitive races. States like Arizona, Michigan, North Carolina, and Georgia will likely see astronomical spending.

Localized Ballot Fights

Beyond federal contests, 2026 will feature ballot measures on abortion, tech regulation, education, and climate — each backed by millions in issue ads.

Rise of CTV and Data-Driven Ads

Connected TV lets campaigns target households with surgical precision. It’s measurable, personalized, and scalable — everything linear TV isn’t. That’s why analysts call CTV the “kingmaker platform” of 2026.

Early Start Strategy

Campaigns now lock media buys months in advance to beat rate hikes. By summer 2025, nearly $900 million was already booked.

Corporate & PAC Influence

Corporate-funded PACs, issue-advocacy groups, and tech-lobby coalitions are shaping ad volume. Meta, Google, and OpenAI collectively spent over $50 million lobbying in 2025 alone.

Real-Life Example: Michigan

Michigan’s local TV and streaming markets will become war-zones of messaging. Competing political ad-buys will drive 30–40% higher rates, displacing small business advertisers.

Influence Beyond Dollars — How Ads Shape Power

Influence isn’t just about money — it’s about who controls the narrative.

The Layers of Influence

- Agenda-Setting: Ads flood the airwaves with certain issues — reframing debates around taxes, immigration, or abortion.

- Message Saturation: High spend = repeated exposure. Even if voters tune out, subconscious recall shapes perceptions.

- Data Manipulation: Digital ad targeting uses AI and behavioral data to micro-segment voters, optimizing messages for emotional triggers.

- Local Media Impact: When political dollars dominate, local outlets grow dependent on campaign cycles for revenue — affecting neutrality.

- Down-Ballot Domination: Spending in small races quietly shifts legislative control at the state level.

Example: Tech Influence

Big-Tech’s 2025 lobbying spree underscores how money shapes policy long before ballots are cast. With nearly $50 million in federal lobbying, the industry’s influence radiates beyond elections — into the architecture of political communication itself.

Which Media Channels Will Dominate 2026

Broadcast and Cable TV

Still crucial for older demographics and local races, but growth is slowing. Saturation and declining TV audiences limit ROI.

Connected TV (CTV) & Streaming

The breakout star of political media. With $2.5 billion projected spending, CTV offers precision targeting and cross-device reach. Campaigns can now tailor messages to zip codes or household profiles.

Digital / Programmatic Ads

Meta, YouTube, and Google Display Network remain staples. Programmatic buying lets campaigns micro-target by geography, issue preference, and browsing behavior.

Radio, Direct Mail & Outdoor

Still present but marginal. Expect radio to decline slightly, while direct mail persists in rural markets for voter recall.

Brand Implications

For brands sharing media channels with political campaigns:

- Expect Cost Inflation: Rates surge during political cycles.

- Preemption Risk: Political ads often get priority placement.

- Brand Safety: Your ad may appear next to polarizing political content.

- Strategic Timing: Shift campaigns to off-peak months or non-battleground states.

Risks, Challenges & Consequences

Voter Fatigue

Overexposure to political messaging risks numbing the electorate. Psychological studies show diminishing returns after 7–10 ad impressions.

Market Inequality

Rising rates favor cash-rich candidates. Local challengers struggle to match media reach, skewing democratic competition.

Brand Disruption

Commercial advertisers in swing markets like Atlanta or Detroit may face 30–60% higher CPMs or preempted placements.

Regulatory Gaps

Digital ad transparency remains weak. Many “dark-money” groups exploit loopholes to mask sponsors.

Ethical Concerns

Micro-targeted messages can reinforce polarization by feeding echo chambers.

Case Study: Tech Lobbying Influence

Tech giants’ combined $50 million lobbying effort in 2025 demonstrates how influence transcends ads — reshaping privacy rules, data access, and online speech moderation before voters even reach the polls.

What to Watch — Key Battlegrounds & Ad Wars

Top Markets Forecasting Record Intensity

- Michigan (AMII 9.17) — Senate + Governor races.

- Georgia (AMII 8.88) — Heavy media saturation in Atlanta.

- Arizona / Nevada — Major Senate + House contests.

- North Carolina & Wisconsin — Swing state bellwethers.

- Pennsylvania & Ohio — High population + overlapping markets.

Emerging Influence Arenas

- Issue Advocacy — Expect massive spending on abortion rights, AI regulation, climate, and education.

- Local Ballot Measures — State referendums will attract outside PAC dollars.

- Streaming Platforms — Hulu, Roku, YouTube TV will sell premium ad packages to campaigns.

Regulatory Flashpoints

The U.S. Supreme Court will soon rule on FEC coordination limits, potentially changing how PACs and campaigns share strategy.

Practical Advice & Takeaways

For Campaigns & Advocacy Groups

Start your media strategy early.

Diversify across TV, CTV, and digital.

Book placements months ahead in swing markets.

Use audience segmentation to avoid wastage.

Monitor disclosure compliance — FEC scrutiny is tightening.

Invest in message testing; saturation without substance backfires.

For Commercial Brands & Marketers

Anticipate cost inflation and inventory scarcity.

Shift budget windows to off-peak or early Q1 – Q2 2026.

Explore alternative media: influencer partnerships, podcasts, and niche streaming.

Ensure brand-safety filters are active on programmatic platforms.

Plan contingency creatives in case political content dominates.

For Voters & Civic Groups

Understand who’s behind each ad — follow the money.

Seek independent fact-checking on viral political claims.

Use Ad Transparency Tools (Google Ad Library, Meta Ad Archive).

Remember: high ad frequency ≠ truth.

Advocate for stronger disclosure laws to protect democratic integrity.

Top 10 Frequently Asked Questions (FAQs)

Q1: How much money will be spent on ads in the 2026 U.S. midterms?

The best available projections: The firm AdImpact forecasts ~US $10.8 billion in political/issue-advocacy advertising in the 2026 cycle. Agency Assembly estimates ~$10.1 billion for the cycle. So we can reasonably expect ad-spend to break the previous midterm record. The challenge is that these are projections and actual spending could vary depending on economy, regulatory changes, major events, or campaign strategies.

Q2: Is the 2026 midterm likely to break record ad-spending compared to previous midterms?

Yes — the projected numbers indicate it will. With 2022 at ~$8.9 billion (per AdImpact) and 2026 projected at ~$10.8 billion, that would represent a ~20%+ increase.Given also the earlier start of spending and rise of new media formats, it is very plausible the record will be broken.

Q3: Which media channels will see the largest growth in political ad spend in 2026?

Connected TV (streaming video) is the top growth channel: AdImpact projects ~$2.5 billion will be spent here in 2026. Digital/video programmatic ads are also rising. Traditional broadcast TV will continue to play a central role, but its growth is likely slower or even slightly down compared to 2024 in some segments.

For campaigns, this means reallocating budgets toward these high-growth areas and optimizing creative for streaming/digital environments.

Q4: What effects will the increased ad-spend have on commercial advertisers and the media market?

Significant ripple effects:

- Local media markets (especially battleground states) will see higher inventory costs, more competition between political and commercial buyers.

- Commercial advertisers may face preemptions or less optimal placements because political buys will command priority in high-stakes markets.

- Brands will need to plan earlier, diversify across channels, and perhaps shift away from heavily contested media markets or time slots.

- Media outlets may rely more on political ad spending, which could influence their editorial environment or inventory structures.

Q5: How will campaign-influence reflect beyond just money? Can spending translate into actual power shifts?

Yes — spending is a necessary but not sufficient condition for influence. When used effectively with data targeting, message resonance, and media saturation, it can shift voter perceptions, turnout, and ultimately election outcomes. For example, heavy spending in down-ballot races or intensive local media markets can tip tight contests.

Moreover, campaigns that invest in early engagement, digital-first strategies and state-level contests often gain structural advantages. That raises concerns about the imbalance of resources — the more money a campaign or group has, the more influence it may exert.

In short: greater spending = higher potential influence, but success still depends on strategy, message, context and execution.

Q6: What are the transparency and regulatory issues tied to rising 2026 ad-spend?

Several challenges:

- Tracking who is spending the money: many political-advocacy groups (so-called “dark money”) may spend large sums without full public disclosure.

- Data-driven targeting and digital channels introduce complexity in understanding how ads reach voters, how they’re optimized, and what effect they have.

- Coordination rules between candidates, parties and outside groups may shift. For example, the Supreme Court has agreed to hear case(s) that could upend coordination spending rules before 2026.

- Media platforms and streaming services may have different ad-disclosure rules compared to broadcast TV, making oversight more difficult.

Q7: What should smaller campaigns or under-funded races expect in 2026? Are they doomed?

Not necessarily doomed — but they will face tougher competition. Key tips:

- Start media-buy planning and creative development earlier.

- Focus on more efficient channels (digital, social, local streaming) where cost may be lower and targeting more precise.

- Leverage grassroots, earned media, local networks and community engagement to compensate for budget constraints.

- Monitor media-market intensity (e.g., saturation) so you don’t overspend in a hyper-competitive market unintentionally.

- Differentiate your message: in a sea of ads, unique story and clarity can help you stand out.

Q8: For non-political brands, how should the 2026 ad-spend surge influence marketing planning?

Brands should:

- Recognize this is a year when media-buy dynamics will be disrupted: political spending will raise rates, soak up inventory, and alter ad-market rhythms.

- Lock in placements early (especially in key markets) to avoid being squeezed.

- Consider alternative channels (niche streaming, influencer marketing, direct-to-consumer digital) where competition might be less intense.

- Monitor brand-safety risks: being near highly partisan or controversial content may impact consumer perception.

- Stay flexible and ready to shift strategy if media-market conditions change mid-cycle.

Q9: Will the 2026 spending surge change how voters perceive campaigns and ads?

Possibly yes:

- Voters may grow fatigued by heavy ad saturation, which could lower ad effectiveness or increase skepticism.

- As campaigns go earlier and more intense, the “campaign season” may feel longer — altering voter behaviour (turnout timing, information-seeking, cynicism).

- With more use of data, targeting and streaming, voters may see more tailored messaging — some may welcome it, others may feel over-targeted or manipulated.

- The visibility of higher-spend races may raise awareness of down-ballot contests and issues, for better or worse.

Q10: What are the strong takeaways for 2026’s midterms about ad-spend and influence?

Ultimately, higher ad-spend amplifies influence potential — so the question becomes whether campaigns and groups can convert that potential into action (turnout, persuasion, power shift) — which remains uncertain.

Do not treat this as “just another midterm.” The scale, media mix and stakes are elevated.

Money matters – but so does media-strategy, timing, creativity and targeting.

For campaigns and brands alike: early planning, diversification across channels, and media-market insight will be competitive advantages.

Voters and civic-groups should pay attention not just to who is spending, but how and why. Transparency, regulation and media-literacy matter more than ever.

Final Thoughts

Whether you’re a campaign strategist, media buyer, brand marketer, or engaged voter, one fact is clear — the 2026 midterms will redefine the economics of political influence.

Record-level ad budgets, early spending, and hyper-targeted messaging are converging into an unprecedented communications battleground.

But the central question remains:

Will all that money translate into real influence — or just more noise?