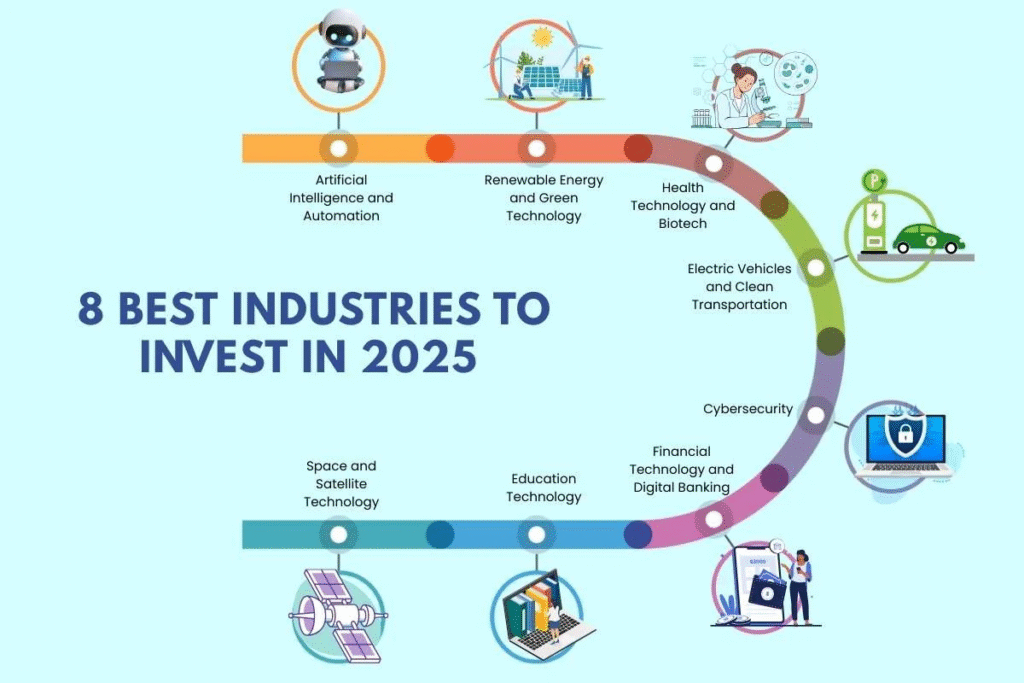

The U.S. investment landscape in 2025 is brimming with opportunities across AI infrastructure, renewable energy, biotech, real estate, and regional banking. As Americans weigh inflation, interest rate shifts, and political uncertainty, investors are seeking diversified and resilient strategies. This article explores the top investment opportunities with real-world examples, FAQs, and practical insights, helping investors navigate what’s trending and profitable in 2025.

Why Is AI Infrastructure Investment Gaining Ground?

Artificial intelligence continues to dominate headlines, but while most investors chase names like Nvidia or Palantir, a quieter revolution is underway. AI infrastructure—the backbone that supports the computing boom—is attracting serious investor attention.

Consider companies like Willdan Group, CBRE, and Primoris. These aren’t AI firms directly producing chips, but they supply the energy, real estate, and power services required to run massive data centers. As cloud providers and big tech pour billions into building AI capacity, these “stealth” stocks could deliver sustainable gains.

A case in point: CBRE’s earnings jumped significantly in mid-2025 due to expanding demand for data center management. One investor who bought shares early in the year reported a 20% portfolio gain in just two months.

Takeaway: For those wanting AI exposure without the froth of overvalued tech giants, infrastructure service providers may offer a steadier route.

Could Regional Banks Offer Attractive Value?

The financial sector has faced turbulence, but regional banks are quietly regaining ground. Stocks like Citizens Financial, KeyCorp, and Regions Financial are trading at discounted valuations compared to their larger peers.

With interest rates expected to ease in late 2025, regional banks may benefit from widening net interest margins and improved lending activity. They’re also closer to local businesses and communities, offering unique growth prospects that large national banks often overlook.

For example, a midwestern investor shifted part of their holdings from JPMorgan to Citizens Financial when valuation gaps widened. By Q2, the move had yielded an 8% gain—a testament to the sector’s hidden potential.

Takeaway: Regional banks remain an undervalued opportunity for investors seeking financial exposure with upside in a rate-cut environment.

Are Aerospace & Defense Stocks Still Strong?

Defense spending in the U.S. remains robust, driven by both domestic priorities and global geopolitical tensions. Meanwhile, demand for aviation is on the rise as airlines modernize fleets and expand post-pandemic capacity.

Companies like GE Aerospace, RTX, and Boeing are seeing accelerating sales growth, and sector ETFs such as XAR and PPA are riding this momentum. Analysts predict that many aerospace and defense firms could outperform broader market indices through 2027.

Takeaway: For long-term investors, aerospace and defense stocks combine reliable government contracts with growing commercial aviation demand, making them a balanced and resilient bet.

How Is Private Equity Capitalizing on Healthcare Manufacturing?

Private equity firms are zeroing in on Contract Manufacturing Organizations (CMOs)—companies that help pharmaceutical and biotech firms scale production. Post-pandemic, demand for outsourced manufacturing has surged, and investors are eager to participate.

Recent deals include Bain Capital’s backing of PCI Pharma Services and Novo Holdings’ acquisition of Catalent. Both moves highlight confidence in healthcare infrastructure as a long-term growth driver.

Takeaway: While retail investors may not directly invest in PE deals, public CMOs and healthcare ETFs offer exposure to this rapidly expanding segment.

Could Gold Be the Safe Haven of Choice?

Amid political uncertainty, many investors are re-evaluating their safe-haven strategies. Interference with Federal Reserve independence has shaken confidence in traditional hedges like bonds, pushing more people toward gold.

Gold ETFs and bullion purchases rose significantly in 2024, and the trend is continuing in 2025. For one retiree, shifting 5% of their portfolio into gold ETFs helped stabilize returns when bond yields dipped unexpectedly.

Takeaway: Gold remains a practical hedge against inflation, political instability, and currency risk—particularly in uncertain times.

What About Stocks That Benefit From Rate Cuts?

If the Federal Reserve moves toward rate cuts later in 2025, companies with heavy debt loads could thrive. Lower borrowing costs would free up capital and boost profitability.

Names like AT&T, Ford, NextEra Energy, First Horizon, and Prologis are positioned to benefit. They also offer healthy dividend yields, which adds appeal in a softening rate environment.

Takeaway: Rate-sensitive stocks can deliver strong returns when interest costs drop. The key is timing investments around Fed policy signals.

Are Real Estate and Housing Catalysts for 2025?

The U.S. continues to face a housing shortage estimated between 2–3 million units. This structural gap creates long-term opportunities in real estate.

High-potential segments include:

- Multifamily housing – particularly in urban growth centers.

- Senior housing – supported by America’s aging population.

- Workforce housing – affordable housing solutions in high-demand markets.

- Industrial real estate – fueled by e-commerce and logistics needs.

New innovations like tokenized real estate are also entering the market, enabling investors to buy fractional shares of properties through blockchain platforms.

Takeaway: Real estate remains one of the strongest structural plays in 2025, with both traditional and digital access points emerging.

Should You Prioritize Renewable Energy Themes?

Renewable energy investment has exploded in recent years, and the U.S. is leading in wind, solar, and battery storage capacity. By 2023, global renewable energy investment jumped by nearly 75%, with the U.S. accounting for a significant share.

Projects like South Fork Wind highlight the expansion of offshore wind, while utility-scale solar installations are rising across multiple states. With installed U.S. wind capacity exceeding 141 GW, the momentum is clear.

Takeaway: Renewables are not just a trend—they are a structural shift. From ESG pressures to government incentives, clean energy remains one of the most promising long-term plays.

Is Biotechnology Breaking Through?

2025 has already seen historic biotech approvals, such as Abeona Therapeutics’ Zevaskyn, a pioneering gene therapy. This underscores the sector’s strength in delivering life-changing innovations.

Beyond gene therapy, biotech opportunities include:

- AI-driven drug discovery – speeding up R&D pipelines.

- Personalized medicine – tailoring treatments to individuals.

- Synthetic biology – revolutionizing healthcare and agriculture.

While biotech investing often requires patience, the rewards for breakthrough success stories can be substantial.

Takeaway: Biotech is a high-risk, high-reward sector, but it offers some of the most exciting growth potential in 2025.

Key Takeaways for Investors

- Diversify across multiple sectors to manage risk.

- Explore AI infrastructure and healthcare manufacturing for structural growth.

- Use gold and real estate as stabilizing hedges.

- Track Federal Reserve policy for rate-sensitive plays.

- Consider ETFs and REITs for diversified exposure with lower complexity.

FAQs – U.S. Investment Opportunities in 2025

1. What sectors benefit most if interest rates drop soon?

Capital-intensive sectors such as utilities, real estate, and automakers are positioned to gain significantly from lower borrowing costs. Reduced interest rates lower financing expenses, making expansion and debt repayment easier. These industries rely heavily on credit access, so easing monetary policy often boosts valuations and investor sentiment toward them.

2. Is gold a worthwhile hedge in 2025?

Yes, gold remains a valuable hedge in 2025. Amid rising inflation risks, geopolitical uncertainty, and global political instability, gold offers protection against currency depreciation and stock market volatility. It serves as a reliable store of value, especially when traditional financial assets face heightened unpredictability in the global economy.

3. How to play AI infrastructure without owning Nvidia?

Investors can access AI infrastructure growth beyond Nvidia by focusing on companies providing critical support, such as CBRE in data center management or Primoris in energy infrastructure. These firms benefit indirectly from AI expansion by enabling technological adoption, offering diversification while reducing exposure to semiconductor industry’s volatility and concentration.

4. Are regional banks a compelling value play?

Yes, regional banks are trading at notable discounts compared to large financial institutions. They stand to benefit from potential interest rate cuts, which reduce funding pressures. With strong local lending relationships and community ties, these banks can rebound significantly, offering attractive value opportunities for investors seeking financial sector exposure.

5. Which real estate segments show strength?

Multifamily housing, industrial properties, and senior living facilities are leading performers. Additionally, tokenized real estate investments—enabled by blockchain—are gaining traction. These segments benefit from strong demand drivers like e-commerce growth, aging populations, and housing shortages, making them resilient and attractive options in an evolving property investment landscape for 2025.

6. Can biotech innovations deliver returns fast?

Biotech innovations often require long regulatory timelines and significant research investment, meaning quick returns are rare. However, breakthrough drugs, vaccines, or therapies can create sharp spikes in valuations. Investors must maintain a long-term horizon, while acknowledging the high-reward potential of successful biotech discoveries that reach commercialization quickly.

7. How significant are sustainable energy investments now?

Sustainable energy investments have become critical in 2025, as renewables represent one of the fastest-growing global markets. With strong government backing, corporate commitments, and advancing technology, sectors like solar, wind, and green hydrogen offer long-term stability and growth. They also address climate change, enhancing their strategic importance worldwide.

8. Should investors include aerospace-defense?

Yes, aerospace and defense remain attractive investments. Heightened geopolitical tensions are driving government military spending, while rising demand for commercial aviation supports growth. These factors combine to make the sector resilient against economic cycles. Investors gain exposure to both steady defense contracts and the expanding commercial aerospace travel market.

9. What about healthcare manufacturing CMOs?

Contract manufacturing organizations (CMOs) in healthcare are thriving. With pharmaceutical and biotech firms outsourcing production to improve efficiency, CMOs see robust demand. Private equity interest highlights the sector’s profitability. Long-term growth is supported by rising drug development pipelines, biologics demand, and the need for scalable, cost-effective global healthcare manufacturing.

10. How to hedge inflation risk in 2025?

Diversification is the key to hedging inflation risks. Investors should allocate to gold for value preservation, real estate for rental income and appreciation, and infrastructure assets for stable cash flows. Together, these provide a balanced defense against purchasing power erosion while ensuring portfolio resilience in uncertain economic conditions.

Conclusion

The top investment opportunities in the U.S. for 2025 span from AI infrastructure and renewable energy to real estate and healthcare. A well-balanced portfolio, diversified across innovation and stability, gives investors the best chance to thrive in uncertain but opportunity-rich times. By aligning with structural growth trends and hedging with safe assets, investors can capture upside while minimizing risk.